Crop micro-insurance could help farmers withstand crop loss caused by adverse weather events. With agriculture the main source of income in Ethiopia, this could provide significant relief to the country’s many smallholder farmers. But before launching an insurance product on the market, it’s important to understand the demand for the product.

We studied the willingness to pay for two insurance products of 1,180 smallholder farmers in rural Ethiopia. We learned that price anchoring plays an important role in determining their willingness to pay.

| What is price anchoring?

Price anchoring is when respondents use the first price shown to them as an ‘anchor’ and become reluctant to pay more than this, regardless of the actual value of the product offered to them next. In this way, price anchoring makes it difficult to determine true willingness to pay in markets with multiple products. |

How did we do it?

We presented two crop micro-insurance products to farmers:

- drought insurance, which covers farmers in case of drought, and

- hybrid insurance, which also covers crop loss due pests or diseases.

We asked farmers for their willingness to pay for drought insurance at one of two randomly selected coverage levels: ETB 2,000 or ETB 4,000. At the selected coverage level, we asked each farmer if they were willing to pay one of five randomly selected premiums, ranging from 5% to 15% of the coverage levels, respectively.

We then repeated the questions for the hybrid insurance, with premiums ranging from 15% to 35% of the coverage levels. We always presented hybrid insurance as equally or more expensive than drought insurance, because it is a more comprehensive product.

What did we find?

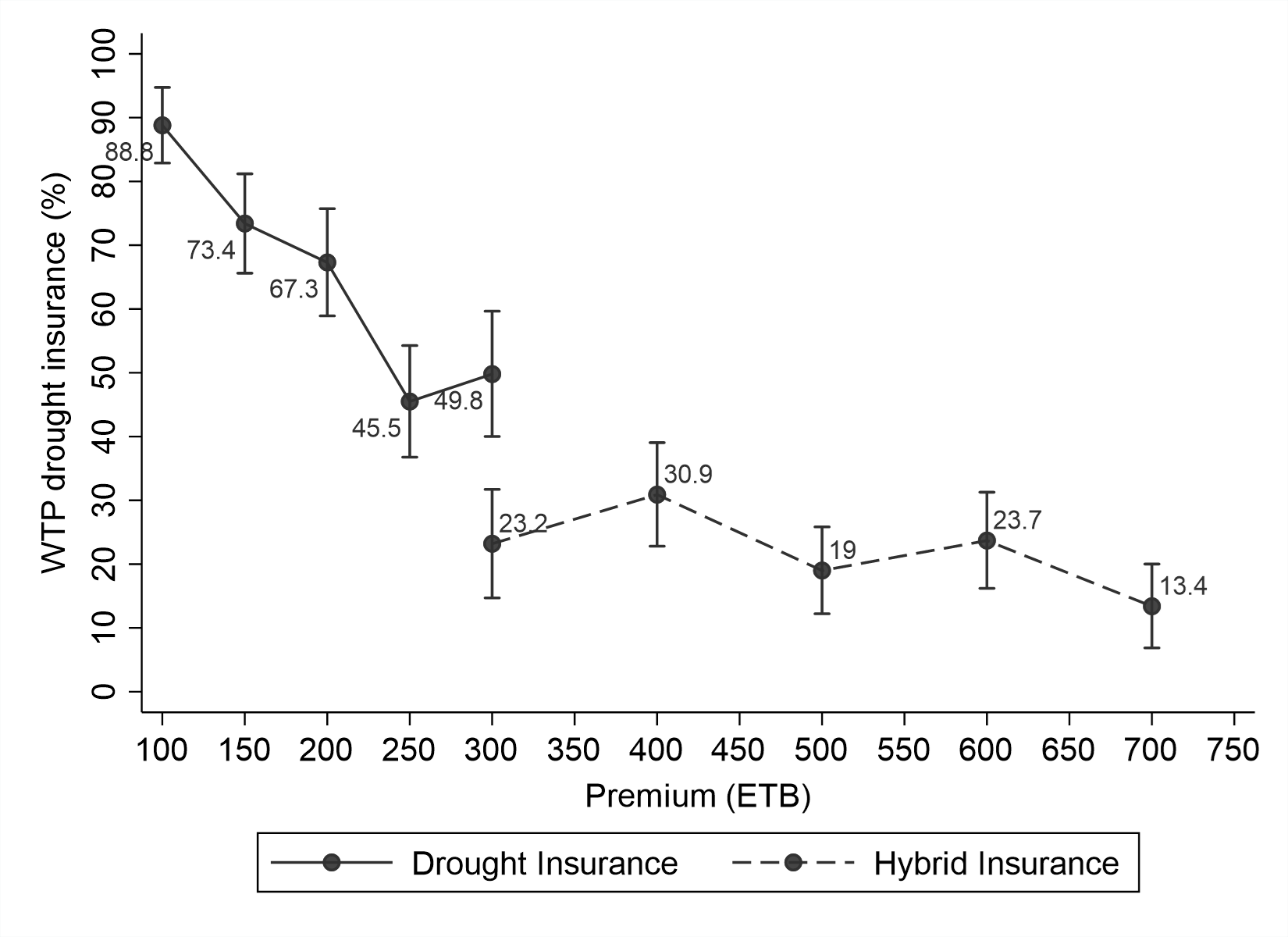

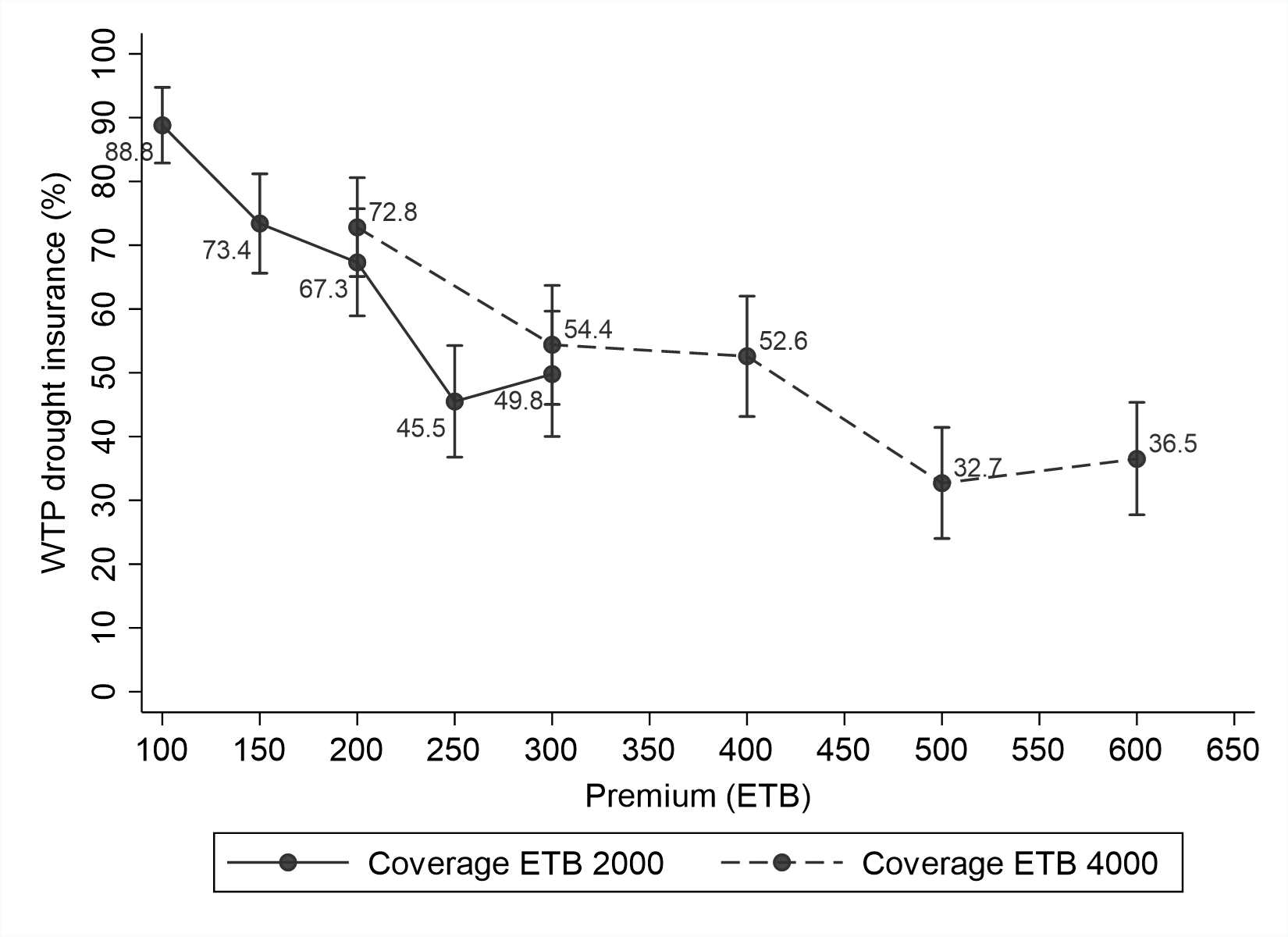

While 88% of farmers reported that they would prefer the hybrid insurance to the drought insurance, they were less willing to pay for the hybrid insurance – even at the same price point as the drought insurance (Figure 1). This suggests that the price of the drought insurance, which was always presented first, influenced farmers’ willingness to pay for the hybrid insurance. We also found that farmers are not willing to pay more for double the insurance coverage (Figure 2).

Given that farmers are not willing to pay for double the coverage and have expressed a preference for the hybrid insurance, we expected that at the same price point, farmers would be more willing to pay for the hybrid insurance with lower coverage than for drought insurance with higher coverage. On the contrary, we found that farmers are willing to pay 20-30 percentage points more for drought insurance with a coverage of ETB 4,000 than for hybrid insurance with half the coverage at a similar price point.

These results suggest that rather than showing true willingness to pay, farmers are ‘anchoring’ to the first – lower – price they are shown. This then influences their willingness to pay for the second product.

Figure 1: Willingness to pay for drought and hybrid insurance at the same coverage level (ETB 2,000)

Figure 2: Willingness to pay for drought insurance at two coverage levels

Implications for the crop micro-insurance market in Ethiopia

Anchoring effects mean we can’t interpret the willingness to pay results for hybrid insurance to accurately reflect farmers’ demand for this specific product. However, our findings have important implications for introducing new products into an insurance market.

The insurance market in Ethiopia is small but growing. When presented with several insurance products, there is a real likelihood that households in rural areas will go for the cheapest insurance option, not the option that provides the best value for money. We have seen that the way – and order – in which the products are presented to potential customers impacts their willingness to pay.

During product design, it is also important keep in mind how the pricing of other insurance products on the market might affect customers’ willingness to pay for new insurance products.

This blog was written by Cox Bogaards, a Research Associate based in Laterite’s Ethiopia office.

The research described in this blog post is part of a study of Ethiopian Smallholder Farmers’ Willingness to Pay for Crop Micro-Insurance conducted by Laterite for the Global Green Growth Institute, the Ethiopian Agricultural Transformation Agency and Kifiya. More information about this study is available in the policy brief, case study and final report.